Market segmentation and positioning of chemical catalyst companies

The market segmentation and positioning of chemical catalyst companies can be analyzed in detail from the following aspects:

Market segmentation

Classified by type: Catalysts can be divided into liquid catalysts and solid catalysts; According to the phase state of the reaction system, it can be divided into homogeneous catalysts and heterogeneous catalysts. Homogeneous catalysts include acid, base, soluble transition metal compounds, and peroxide catalysts; Divided by function, taking into account market types and application industries, it is divided into petroleum refining, inorganic chemical industry, organic chemical industry, environmental protection, and others; According to the type of reaction, catalysts can be divided into polymerization, condensation, esterification, hydrogenation, dehydrogenation, oxidation, reduction, etc.

By application field: The global catalyst market is divided into petroleum refining, chemical synthesis, polymer catalysis, petrochemicals, environment, etc. Petroleum refining is the largest application field, followed closely by chemical synthesis and polymer catalysis.

Typical companies and their market positioning

PetroChina Lanzhou Petrochemical Catalyst Plant: This plant is the largest FCC catalyst production base in China, with an annual production capacity of up to 50000 tons. Its main products include more than 40 types of products from nine series. Its 6000 tons/year ultra stable molecular sieve device and all clay device represent the top technological level in China.

China Petroleum Fushun Petrochemical Catalyst Factory: focuses on the research and development, production, and recycling of precious metal catalysts for petroleum processing. Its main products include seven major categories of products such as hydrogenation refining, hydrogenation cracking, and catalytic reforming, with an annual production capacity of nearly 5000 tons.

Shandong Gongquan Chemical Co., Ltd. focuses on the research and production of catalysts in multiple fields, including residue hydroprocessing, hydrocarbon conversion for hydrogen production, hydrocracking and refining.

Beijing Sanju Environmental Protection New Materials Co., Ltd. is committed to the research and development, production, and sales of catalysts, petrochemical additives, and catalytic new materials. Its products are widely used in various industries such as refining, chemical, natural gas, and fertilizers.

Industry development trends and competitive landscape

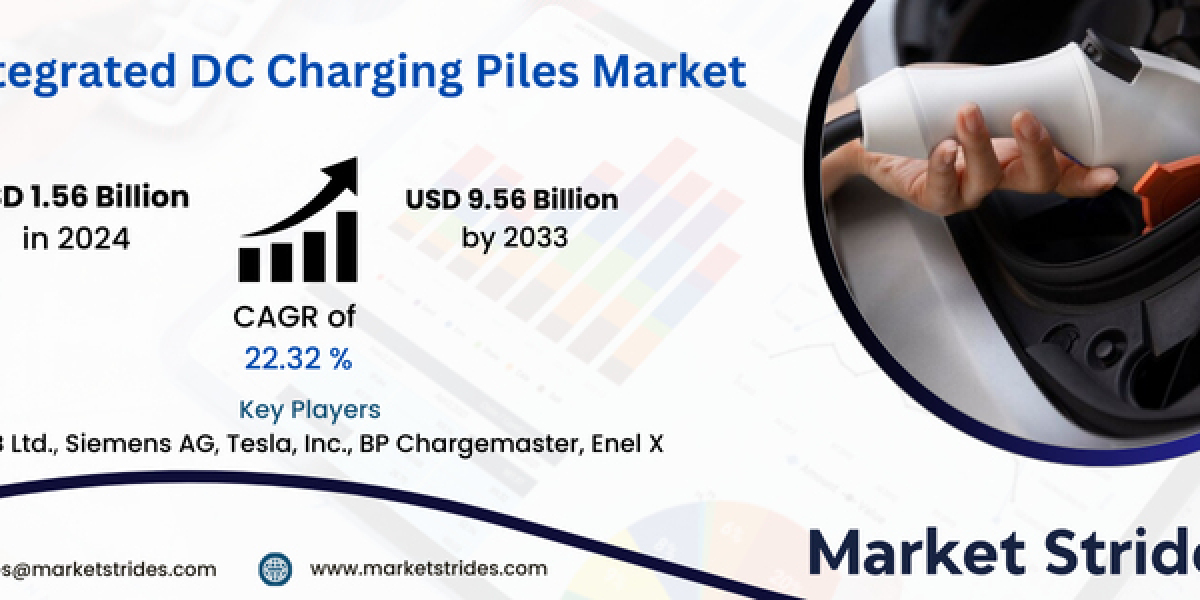

Market size and growth trend: The global catalyst market is expected to reach $27.03 billion in 2024 and is projected to grow to $37.31 billion by 2031, with a compound annual growth rate of 4.8%. The growth momentum mainly comes from the surge in environmental demand in the Asia Pacific region, the expansion of refining capacity brought about by the North American shale gas revolution, and the upgrading of green chemical technology driven by Europe's carbon neutrality goals.

Competitive landscape: The global catalyst market presents a pattern of "Europe and America leading technology, Asia Pacific leading production capacity". The main manufacturers include BASF, Johnson Matthey, etc. The total market share of the top five global manufacturers is 60%, and the industry CR10 exceeds 75%, presenting an oligopoly monopoly pattern.